Selecting the right bank account for your business ensures smooth financial operations and fosters growth. Entrepreneurs need an account offering convenience and robust features tailored to their needs. The best business bank accounts provide low fees, high transaction limits, and comprehensive online banking capabilities. These features streamline operations, making financial management more efficient and less time-consuming.

Additionally, top business bank accounts offer excellent customer service and additional benefits like integration with accounting software, fraud protection, and rewards programs. This article delves into the top 10 best business bank accounts, highlighting their unique advantages and why they stand out in the competitive banking landscape. By exploring these options, entrepreneurs can find an account that aligns with their business needs, ensuring optimal financial health and supporting business growth.

In This Article

ToggleBest Business Bank Accounts

Criteria for Selection

Choosing a business bank account involves comprehensively evaluating several factors to ensure it meets your specific business needs. Entrepreneurs should consider key criteria such as fees, transaction limits, accessibility, customer service, and additional features. Understanding these factors can help select an account that supports efficient financial management and fosters business growth.

- Fees and Charges: Understanding monthly fees, transaction fees, and the conditions for waiving these fees is crucial. Many business bank accounts charge maintenance fees, but some offer ways to waive them, such as maintaining a minimum balance or meeting certain transaction thresholds. Transaction fees can add up, so knowing the limits and costs associated with deposits, withdrawals, and transfers is essential. By carefully evaluating these costs, businesses can choose an account that minimizes expenses and maximizes savings.

- Transaction Limits: Different accounts have varying limits on deposits and withdrawals, which can impact daily operations. High transaction volumes can lead to additional fees if limits are exceeded. Choosing a business bank account that aligns with your typical transaction frequency and volume is essential. Accounts with higher transaction limits benefit businesses with frequent deposits and withdrawals, ensuring smoother financial operations without incurring extra charges.

- Accessibility: Online and mobile banking capabilities are essential for modern businesses. These features provide convenience and flexibility, allowing business owners to manage accounts, transfer funds, and pay bills from anywhere. Look for accounts with robust online platforms and user-friendly mobile apps. Accessibility to a network of ATMs and branches is also essential for cash deposits and withdrawals, providing added convenience and operational efficiency.

- Customer Service: Reliable support can be a lifesaver when facing banking issues. Excellent customer service ensures that problems or questions are addressed promptly and effectively. Look for banks that offer dedicated business banking support with accessible customer service channels such as phone, email, and chat. Strong customer service can provide peace of mind and help maintain smooth financial operations, especially during critical times.

- Additional Features: Overdraft protection, integration with accounting software, and earning interest on balances are beneficial extras. Overdraft protection can prevent costly fees and interruptions in business operations. Integration with accounting software simplifies financial management by streamlining data entry and reconciliation processes. Accounts that offer interest on balances can help businesses earn extra income on their deposits. These additional features enhance a business bank account’s overall value and functionality, making financial management more efficient and effective.

Top Business Accounts – Features to Consider

When evaluating business bank accounts, consider several key features to ensure the best fit for your business. These features include low or no monthly fees, high transaction limits, robust online banking, cash deposit options, and excellent customer support. By carefully assessing these factors, you can select an account that optimizes your financial operations and supports business growth.

- Low or No Monthly Fees: Accounts that offer fee waivers based on maintaining a minimum balance or conducting specific transactions can save money. Many banks provide options to waive monthly maintenance fees if criteria are met, such as retaining a specified average balance, linking accounts, or completing a set number of monthly transactions. Choosing an account with low or no monthly fees reduces overhead costs, allowing businesses to allocate more funds toward growth and operations. This feature especially benefits startups and small businesses aiming to minimize expenses.

- High Transaction Limits: Higher limits prevent extra fees for businesses with numerous transactions. Many business bank accounts have caps on the number of free transactions allowed per month, including deposits, withdrawals, and transfers. Exceeding these limits can incur additional charges, which add up over time. Selecting an account with high or unlimited transaction limits ensures your business can conduct its daily operations without worrying about excess fees. This is particularly advantageous for companies with high transaction volumes, ensuring seamless financial management and cost efficiency.

- Robust Online Banking: A user-friendly online platform can streamline operations and provide easy access to funds. Robust online banking features include real-time account monitoring, easy transfers, bill payments, and remote deposit capabilities. These tools allow business owners to manage their finances efficiently, saving time and reducing the need for in-person banking visits. A well-designed online banking platform enhances operational efficiency and provides flexibility, enabling businesses to respond quickly to financial needs and opportunities.

- Cash Deposit Options: Businesses dealing in cash need flexible deposit solutions. Some bank accounts offer free or low-cost cash deposits up to a certain limit, accommodating the needs of businesses that handle significant cash transactions. Features such as deposit-ready ATMs and extended branch hours make cash deposits convenient and secure. Choosing an account with favorable cash deposit terms helps businesses manage their cash flow effectively, ensuring funds are readily available for operations and investments.

- Customer Support: Access to dedicated support channels ensures quick issue resolution. Excellent customer service is crucial for addressing banking problems promptly and efficiently. Look for banks that offer multiple support options, including phone, email, and live chat, as well as dedicated business banking representatives. Reliable customer support provides peace of mind and helps maintain smooth financial operations, allowing business owners to focus on their core activities without being sidetracked by banking issues.

Chase Business Complete Banking

Overview

Chase Business Complete Banking is popular for small businesses due to its comprehensive features and wide accessibility. It offers a blend of low fees, robust online and mobile banking, and extensive branch and ATM networks, making it a convenient and efficient option for business owners.

Key Benefits

- Low Monthly Fees: The $15 monthly fee can be waived with a daily balance of $2,000. This allows businesses to save on banking costs, making it an affordable option for maintaining operational efficiency. Meeting the minimum balance requirement helps avoid additional charges and optimize financial management.

- Transaction Allowance: Chase Business Complete Banking provides 100 free transactions per month. This generous allowance is particularly beneficial for businesses with high transaction volumes, as it reduces the likelihood of incurring extra fees. It supports smooth daily operations without additional transaction costs.

- Integrated Tools: Chase offers free online bill pay, fraud protection services, and integration with various accounting software. These tools streamline financial management, enhance security, and improve operational efficiency. Businesses can manage their finances more effectively with these integrated features.

- Mobile Banking: The robust mobile app allows for deposits, transfers, and payments on the go. This flexibility ensures business owners can manage their accounts anytime, anywhere, enhancing convenience and accessibility. The app’s features support efficient, mobile-friendly financial operations.

- Branch Accessibility: With numerous branches and ATMs nationwide, Chase provides widespread accessibility. This extensive network makes it easy for businesses to access banking services wherever they are, ensuring that deposits, withdrawals, and other banking activities are convenient and hassle-free.

Bank of America Business Advantage

Overview

Bank of America’s Business Advantage accounts offer tailored solutions for growing businesses, with multiple tiers based on business needs. These accounts provide scalable options, rewards programs, and comprehensive digital banking services, making them a versatile choice for businesses of all sizes.

Key Benefits

- Scalable Options: Various account levels cater to businesses of different sizes and transaction volumes. This scalability ensures your banking needs are met as your business grows without switching banks. Each tier offers specific features to support various operational requirements, providing flexibility and adaptability.

- Rewards Program: Earn cashback and rewards through the Preferred Rewards for Business program. This program offers financial incentives for maintaining certain balances and completing qualifying activities. Rewards can include cashback, discounts, and other benefits, adding value to your banking relationship and enhancing your business’s financial health.

- Online and Mobile Banking: Comprehensive online services and a highly rated mobile app make managing finances easy. These digital tools provide real-time access to account information, enable transactions, and offer features like mobile check deposits. This convenience supports efficient financial management and ensures accessibility from anywhere.

- Fee Waivers: There are easy ways to waive monthly fees, such as maintaining a minimum balance or linking to a personal account. These options help businesses reduce banking costs, making it easier to manage expenses. Fee waivers ensure that maintaining an account remains cost-effective, especially for small and growing businesses.

- Cash Flow Monitoring: Tools and resources help effectively manage and forecast cash flow. Bank of America’s cash flow management tools offer insights into income and expenses, assisting businesses in planning and budgeting more accurately. These resources support better financial decision-making and ensure smoother operational processes.

Wells Fargo Business Choice Checking

Overview

Wells Fargo Business Choice Checking is designed for small businesses needing flexible banking solutions. This account offers manageable fees, generous transaction limits, dedicated support services, robust online banking, and additional financial services, making it a comprehensive choice for small business owners.

Key Benefits

- Low Fees: A manageable monthly fee with several ways to waive it, including minimum balance requirements. Businesses can avoid the $14 monthly fee by maintaining a $7,500 average balance or through specific types of transactions. This flexibility helps small companies manage costs effectively.

- Transaction Volume: 200 free transactions per month, ideal for active businesses. This high transaction limit accommodates businesses with frequent deposits, withdrawals, and transfers, helping to avoid additional fees. The generous allowance supports daily operational needs without extra costs.

- Support Services: Access to Wells Fargo’s dedicated business bankers and resources. Businesses benefit from personalized advice and support, helping to navigate financial decisions and challenges. This dedicated assistance ensures that business owners have expert guidance readily available.

- Online Banking: Strong online presence with excellent mobile app support. Wells Fargo’s digital banking services include real-time account access, mobile check deposits, and secure transactions. The robust online and mobile platforms ensure convenient and efficient financial management.

- Additional Services: Options for payroll services and business loans. Wells Fargo provides integrated financial solutions, including payroll management and access to business credit options. These extra services enhance the account’s value, offering comprehensive support for various business needs.

Capital One Spark Business

Overview

Capital One Spark Business accounts are tailored for entrepreneurs looking for straightforward, no-fee banking. These accounts offer a blend of cost-effective features, unlimited transactions, and comprehensive digital banking services, making them ideal for businesses that seek simplicity and efficiency in their banking operations.

Key Benefits

- No Monthly Fees: No monthly maintenance fees make it cost-effective. Businesses can save money by avoiding regular fees, allowing them to allocate resources more efficiently. This feature particularly benefits startups and small companies focused on minimizing expenses.

- Unlimited Transactions: There are no transaction limits, which benefits businesses with high transaction volumes. Unlimited transactions mean companies can conduct as many deposits, withdrawals, and transfers as needed without incurring extra charges. This flexibility supports seamless financial operations.

- Cash Deposits: There are no monthly fees for cash deposits up to $5,000. This generous allowance is advantageous for businesses that handle significant amounts of cash, helping them manage deposits without worrying about additional fees. It provides cost-effective cash management solutions.

- Online and Mobile Banking: Comprehensive online services and a powerful mobile app. Capital One’s digital banking tools enable businesses to manage accounts, make payments, and monitor transactions quickly and securely from anywhere. The robust mobile app enhances accessibility and operational efficiency.

- Customer Support: 24/7 customer service with support from dedicated business specialists. Businesses can access round-the-clock assistance, ensuring that any issues or questions are promptly addressed. Dedicated support enhances the overall banking experience and provides peace of mind.

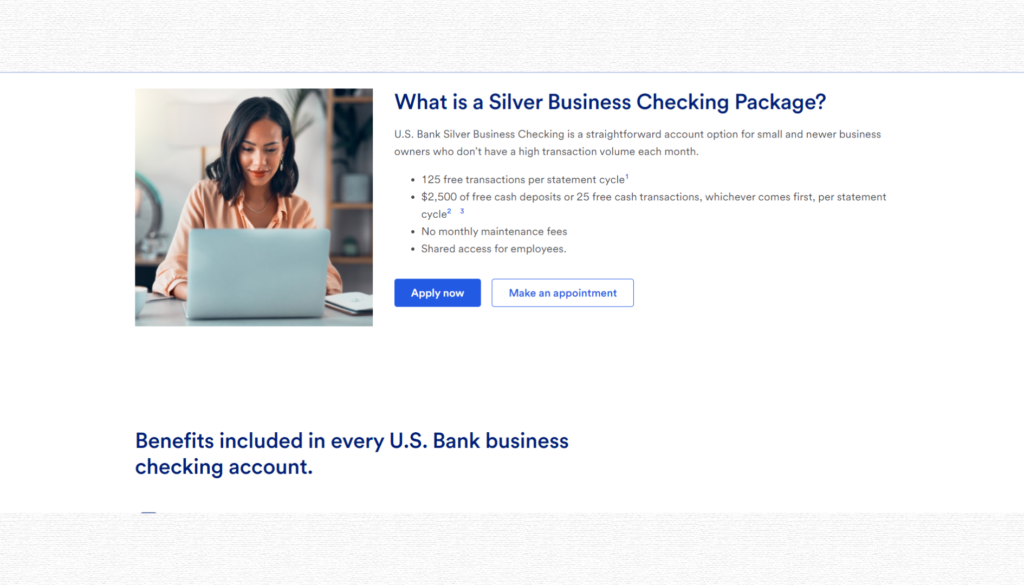

U.S. Bank Silver Business Checking

Overview

U.S. Bank’s Silver Business Checking is designed for startups and small businesses with modest banking needs. This account offers essential features like no monthly fees, a decent number of free transactions, cash deposit allowances, robust online banking, and access to financial planning tools, making it a practical and cost-effective option for small enterprises.

Key Benefits

- No Monthly Fees: This account does not charge monthly maintenance fees. Small businesses and startups can benefit from this cost-saving feature, allowing them to focus their resources on growth and operations without worrying about recurring banking costs. This makes it an attractive option for businesses with tight budgets.

- Transactions: There are 125 free monthly transactions, sufficient for smaller businesses. This allowance covers a range of activities, including deposits, withdrawals, and transfers. It helps companies to manage their daily operations without incurring extra fees, providing a flexible and economical solution for handling routine banking needs.

- Cash Handling: Free cash deposits up to $2,500 per month. This feature supports businesses that handle a moderate amount of cash, allowing them to deposit funds without additional costs. It ensures efficient cash management and helps maintain liquidity without incurring extra fees.

- Online Banking: Access to a robust online platform and mobile app. U.S. Bank provides comprehensive digital banking services, enabling businesses to manage accounts, conduct transactions, and monitor finances remotely. The user-friendly online platform and mobile app enhance convenience and operational efficiency.

- Financial Tools: Provides access to financial planning tools and resources. U.S. Bank’s Silver Business Checking account includes resources to help businesses plan and manage their finances effectively. These tools support budgeting, cash flow management, and financial forecasting, assisting businesses in making informed decisions and achieving their financial goals.

TIAA Bank Small Business Checking

Overview

TIAA Bank provides competitive business checking accounts tailored to businesses of diverse sizes. Their offerings include interest-bearing accounts, fee waivers for monthly maintenance, a generous transaction allowance, efficient online and mobile banking services, and dedicated customer support.

Key Benefits

- Interest-Bearing Accounts: TIAA Bank’s business checking accounts offer interest on your balance, a feature not commonly found in similar business account offerings. This allows businesses to earn passive income on their deposited funds, enhancing overall financial efficiency and returns.

- Fee Waivers: The bank provides straightforward methods for businesses to waive the monthly maintenance fee associated with their checking accounts. This flexibility is advantageous for businesses looking to minimize operational costs and manage expenses effectively.

- Transaction Allowance: Businesses benefit from up to 200 free transactions per month, accommodating varying levels of transactional activity without incurring additional fees. This feature benefits busy businesses frequently engaging in financial transactions, providing cost predictability and control.

- Online and Mobile Banking: TIAA Bank offers robust digital banking services that are both efficient and user-friendly. These services enable businesses to manage their finances conveniently, perform transactions remotely, and access account information securely at any time, enhancing operational flexibility and efficiency.

- Customer Service: Businesses receive dedicated support from knowledgeable representatives at TIAA Bank. This ensures that businesses can promptly resolve any inquiries or issues related to their checking accounts, fostering a reliable banking relationship built on responsive and personalized customer service.

PNC Business Checking

Overview

PNC provides a range of business checking accounts designed to scale alongside your business’s growth. Their offerings cater to diverse business needs and include customizable account options, comprehensive cash flow management tools, flexible fee waiver options, generous transaction limits, and robust online and mobile banking services.

Key Benefits

- Customizable Accounts: PNC offers multiple business checking accounts tailored to meet varying business requirements for small startups or larger enterprises. This customization ensures companies can choose the account that best fits their financial operations and growth strategies, providing flexibility and scalability.

- Cash Flow Insight: PNC equips businesses with tools to effectively manage and forecast cash flow. These resources enable enterprises to monitor their financial health, optimize liquidity, and make informed decisions to support sustainable growth and stability.

- Fee Waivers: Businesses can access several methods to waive monthly fees associated with their checking accounts. This flexibility helps businesses control operating costs and allocate resources more efficiently, ensuring that financial management remains transparent.

- Transaction Limits: PNC offers generous transaction allowances, accommodating businesses with varying transaction volumes. This feature ensures that companies can handle their daily financial activities without incurring excessive fees, promoting financial predictability and operational efficiency.

- Online and Mobile Banking: PNC provides robust digital banking services with a user-friendly mobile app. These services empower businesses to manage their finances conveniently and securely from anywhere. They facilitate seamless transactions, account monitoring, and access to banking services on the go, enhancing overall operational agility and responsiveness.

Citibank Business Checking

Overview

Citibank offers business checking accounts tailored to support businesses at every growth stage. Their offerings include global accessibility, customizable solutions, robust online banking services, dedicated customer support, and efficient cash management tools.

Key Benefits

- Global Reach: Citibank’s business checking accounts are advantageous for businesses involved in international transactions. With their global network and expertise, companies can seamlessly manage cross-border payments, currency conversions, and international business operations, enhancing financial efficiency and global market reach.

- Customizable Solutions: Citibank provides multiple account options to meet diverse business needs. Whether a small startup or a multinational corporation, businesses can choose accounts that align with their specific financial requirements, promoting flexibility and scalability as their business evolves.

- Online Services: Citibank offers comprehensive online and mobile banking services. These digital platforms empower businesses to perform transactions, manage accounts, and access financial information securely and conveniently from anywhere. This enhances operational efficiency, supports real-time decision-making, and ensures seamless integration with other financial management tools.

- Customer Support: Businesses benefit from dedicated support from Citibank’s business banking specialists. This personalized assistance ensures businesses receive tailored financial solutions, prompt resolution of inquiries or issues, and strategic guidance to optimize their banking experience and business operations.

- Cash Management: Citibank equips businesses with efficient cash management tools and resources. These tools help companies to optimize cash flow, streamline financial operations, and maximize liquidity management strategies. By providing robust cash management solutions, Citibank supports businesses in achieving greater economic control, operational efficiency, and profitability.

BBVA USA Business Connect Checking

Overview

BBVA USA provides business checking accounts designed to offer flexibility and value to businesses of all sizes. Their offerings feature affordable monthly fees with straightforward waiving methods, generous transaction limits before fees apply, excellent online and mobile banking capabilities, free cash deposits up to a specified limit, and reliable customer support from dedicated business banking specialists.

Key Benefits

- Low Fees: BBVA USA’s business checking accounts come with affordable monthly fees, ensuring companies can manage their operational costs effectively. The bank also provides easy-to-meet criteria for fee waivers, allowing enterprises to avoid unnecessary expenses and maintain financial efficiency.

- Free Transactions: Businesses benefit from generous transaction limits before fees apply, enabling them to conduct daily financial activities without incurring additional costs. This feature supports businesses in managing their cash flow effectively, promoting financial predictability and operational flexibility.

- Digital Banking: BBVA USA offers robust online and mobile banking capabilities, providing businesses with convenient access to account information, transactional capabilities, and financial management tools anytime and anywhere. These digital services enhance operational efficiency, streamline banking processes, and support businesses in making timely financial decisions.

- Cash Deposits: Businesses can make free cash deposits within a specified limit with BBVA USA’s business checking accounts. This feature is particularly beneficial for companies that deal with cash transactions regularly, reducing operational costs associated with depositing funds and optimizing liquidity management.

- Customer Service: BBVA USA provides reliable customer support from knowledgeable business banking specialists. Businesses can access personalized assistance, receive prompt resolution of inquiries or issues related to their checking accounts, and benefit from strategic guidance to optimize their banking experience and effectively support their business goals.

Axos Bank Business Interest Checking

Overview

Axos Bank offers standout interest-bearing business checking accounts, allowing businesses to earn interest on their balances. These accounts feature no monthly maintenance fees, ensuring they remain budget-friendly. Axos Bank also provides generous transaction allowances to accommodate the needs of busy businesses, along with comprehensive and user-friendly online and mobile banking services. Businesses benefit from dedicated support from Axos Bank’s business banking professionals, ensuring personalized assistance and strategic guidance to optimize their banking experience.

Key Benefits

- Interest Earnings: Axos Bank’s interest-bearing business checking accounts allow businesses to earn interest on their balances. This feature adds value to deposited funds, potentially generating passive income for businesses while they manage their daily financial operations.

- No Monthly Fees: Businesses can benefit from Axos Bank’s business checking accounts without worrying about monthly maintenance fees. This cost-saving benefit helps companies to allocate resources more effectively, enhancing financial predictability and operational efficiency.

- Transaction Limits: Axos Bank offers generous transaction allowances, enabling businesses to conduct significant transactions without additional fees. This flexibility supports businesses with varying transaction volumes, ensuring they can manage their daily financial activities smoothly and cost-effectively.

- Online and Mobile Banking: Axos Bank provides comprehensive online and mobile banking services that are user-friendly and accessible anytime, anywhere. These digital platforms empower businesses to manage their accounts, perform transactions, and access financial information securely and efficiently, enhancing operational convenience and flexibility.

- Customer Support: Businesses receive dedicated support from Axos Bank’s business banking professionals. This personalized assistance ensures businesses can promptly resolve inquiries or issues related to their checking accounts, receive expert guidance on financial strategies, and optimize their banking experience to support their business growth and success.

Choosing the Right Account for You

Assessing Your Business Needs

Choosing the optimal business bank account hinges on thoroughly assessing your business’s unique requirements. Begin by evaluating factors like your typical transaction volume, whether you handle significant cash deposits and the criticality of robust digital banking services. Transaction volume dictates the need for an account with adequate free transactions or low transaction fees. For businesses handling cash, look for accounts offering free or low-cost cash deposit allowances. Additionally, prioritize accounts with reliable online and mobile banking capabilities, which is crucial for managing finances efficiently and accessing real-time financial data. Understanding and aligning these factors ensures you select a business bank account that supports your operational needs while optimizing financial management and growth opportunities.

Comparing Account Features

Once you’ve assessed your business’s requirements, compare account features to find the optimal balance of cost, convenience, and additional services. Consider accounts that not only meet your basic transaction and cash handling needs but also offer value-added services such as robust online banking, mobile app functionality, and possibly perks like interest-bearing options or fee waivers. Prioritize accounts that streamline financial operations, provide flexibility in managing cash flow, and offer convenient tools for monitoring and controlling your finances. Choosing an account with the right blend of features ensures it supports your business effectively while optimizing operational efficiency and financial management.

Tips for Managing Your Business Account

Maintaining Minimum Balances

Many business bank accounts offer fee waivers if you maintain a specified minimum balance. Monitoring your account balance regularly ensures you meet this requirement, preventing unnecessary monthly fees. By staying attentive to your balance, you can manage your account to minimize costs and allocate resources more efficiently. This practice helps maintain financial discipline and ensures that your business banking remains cost-effective, allowing you to focus resources on growth and operational needs rather than fees.

Avoiding Unnecessary Fees

Be aware of transaction limits and potential fees when selecting a business bank account. Opt for an account that aligns with your typical transaction volume to reduce costs associated with exceeding limits. Utilizing online banking features can also help avoid fees related to in-branch transactions, offering convenience and cost savings. By choosing an account that suits your transaction needs and leveraging digital banking tools effectively, you can manage expenses efficiently, maintain financial control, and optimize your business’s banking experience for greater operational efficiency and savings.

Conclusion – Best Business Banking Options

Selecting the correct business bank account is crucial for effective financial management. The top 10 best business bank accounts typically vary in features and benefits, catering to diverse business needs. Start by assessing your company’s requirements, such as transaction volume, cash handling, and digital banking preferences. Compare the accounts based on criteria like monthly fees, transaction limits, interest rates on balances, and availability of online banking tools.

Look for accounts that offer a good balance between cost savings and convenience. Some accounts may waive monthly fees if you maintain a certain balance or offer generous transaction allowances. Others might provide competitive interest rates on deposits or comprehensive digital banking platforms for easy account management. By evaluating these factors and choosing an account that aligns closely with your business priorities, you can streamline financial operations, minimize costs, and ensure your banking services support your business growth effectively. This approach helps optimize financial efficiency while providing the necessary tools to manage cash flow and monitor financial health efficiently.

FAQs

Which bank offers the best business accounts?

The best business bank account depends on your specific needs. Chase, Bank of America, and Wells Fargo are highly rated for their comprehensive features and customer support.

What should I look for in a business bank account?

Look for low fees, high transaction limits, robust online banking, and strong customer support. Additional features like integration with accounting software and cash handling services are also important.

Are there fees for business bank accounts?

Many business bank accounts charge monthly maintenance, transaction, and cash deposit fees. However, some accounts offer ways to waive these fees.

Can I open a business bank account online?

Yes, many banks allow you to open a business bank account online. Ensure you have ready the necessary documentation, such as your business registration and identification.

Do I need a business bank account for my LLC?

Yes, having a separate business bank account for your LLC is recommended to maintain clear financial records and simplify tax filing.

How can I switch my business bank account?

To switch your business bank account, open a new account, transfer your funds, update your payment information with vendors, and close the old account once all transactions have cleared.