The global payments and transactions sector is evolving quickly. It’s clear that secure, accessible, and affordable payment systems support development and improve financial inclusion and stability.

MasterCard is competing to handle financial payments for member banks. One of its offerings, MasterCard Send, provides advanced payment management. This service uses existing networks and platforms to facilitate disbursements and payments to almost all US debit card accounts, efficiently processing transfers from both domestic and international sources. Security and speed are key features of this service, with MasterCard describing it as “the first of its kind.”

Unlike other money transfer companies, MasterCard Send acts not as a payment provider but as a payment management service that can connect to nearly any bank account, whether associated with MasterCard or not. Continue reading to learn more about this service.

In This Article

ToggleTable of Contents

An Overview of the MasterCard Send

MasterCard Inc. introduced ‘MasterCard Send’ in 2015, a platform for cross-border payments similar to Visa Direct. It’s a unique, interoperable global platform that facilitates the fast and secure transfer of funds for both individual consumers and businesses.

The service is built around three main types of transactions—disbursements from organizations such as businesses, non-profits, and government bodies to individuals; domestic payments; and international person-to-person (P2P) transactions. Its flexibility is evident as it supports various payment channels, including mobile money, payment cards, cash-out agents, and bank accounts, making it a comprehensive option for transferring funds.

MasterCard Send ensures security and incorporates effective pricing controls, which help streamline operations and simplify settlements. This, in turn, improves customer experiences and ensures robust compliance throughout the transaction process.

How Does MasterCard Send Work?

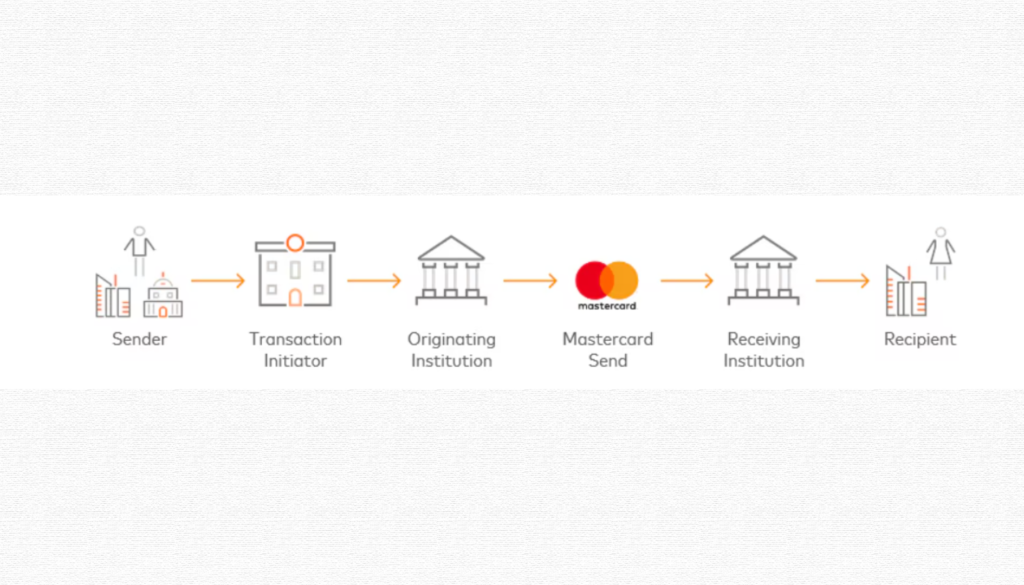

MasterCard Send is a versatile platform designed to facilitate domestic and international real-time money transfers. Unlike traditional payment systems that rely on the slower Automated Clearing House (ACH) network, MasterCard Send utilizes debit networks, completing transfers within seconds or minutes. With Mastercard Send, you can transfer funds to almost any debit card in the U.S. using a series of APIs.

This service allows providers to initiate a transfer with one sending provider, and Mastercard then directs it to any U.S. bank through a card, regardless of the card’s brand. This feature enables consumers to send and receive money using devices linked to any bank.

Here’s how MasterCard Send operates:

- Payment Initiation: The process begins when a sender initiates a transaction by providing the recipient’s debit card details, including the card number, expiration date, and full name associated with the card.

- Funds Transfer: The sender’s financial institution temporarily holds the funds in a settlement account then communicates with MasterCard through the Send API to initiate the transfer.

- Network Processing: MasterCard processes the payment details and sends them to the appropriate debit network.

- Fund Reception: The recipient’s bank receives the funds, and the transaction is completed, with both parties notified.

Recipients can choose various methods to receive their money, including bank deposits, credits to a MasterCard or other branded cards, payouts to mobile wallets, or cash pickups at designated locations. This flexibility, combined with the speed of transactions, positions MasterCard Send as a powerful tool for businesses, governments, and individuals needing to make swift payments across a variety of contexts.

What Are the Benefits of MasterCard Send?

MasterCard Send offers many benefits as it operates independently of a bank’s ACH system, eliminating the need for bank account details during fund transfers. This simplifies the entire process. A significant benefit of using MasterCard Send is that funds are sent directly and automatically to the recipient almost instantly. This system supports immediate transfers, a capability that traditional banks do not offer. As a result, the recipient receives the funds right after the sender initiates the transfer.

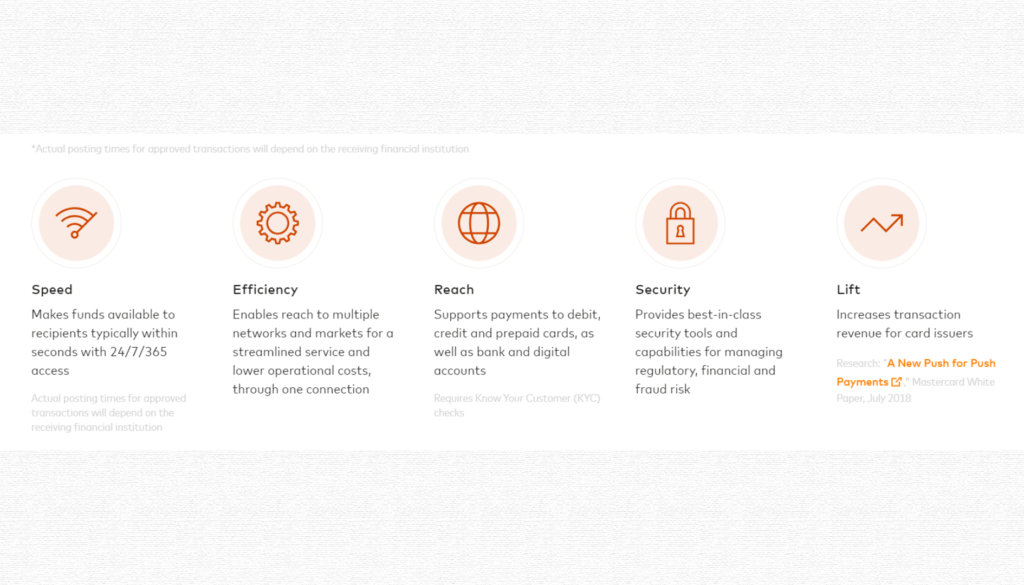

MasterCard Send offers several benefits that enhance the efficiency and security of money transfers for various stakeholders, including consumers, businesses, and government agencies.

- Speed and Accessibility: MasterCard Send enables near-instant transfers, making it a swift option for sending and receiving funds. It can reach virtually all debit card accounts, providing broad accessibility without the need for recipients to share detailed bank information. This feature also brings total transparency in costs to the customer by displaying exchange rates, charges, and transaction amounts at the point of entry.

- Versatility Across Different Needs: The service supports various payment needs, from disbursements and remittances to P2P and cross-border transactions. This makes it suitable for different users, including gig workers, businesses, and even humanitarian organizations that must deliver funds across various channels. The integration with banks’ existing systems, like Core Banking, Compliance Engine, and Payment Engine, facilitates this versatility.

- Enhanced Customer Experience: MasterCard Send enhances user satisfaction and engagement by providing near-real-time payment capabilities. This feature is particularly valuable for businesses and platforms that need to ensure quick payouts to maintain high service levels. It offers better tracking of the payment life cycle, with instantaneous status updates to the originating channels as well as continuous updates during payment processing and confirmation of credit.

- Security and Risk Management: MasterCard Send incorporates robust security measures to protect against fraud and money laundering. These measures are crucial for maintaining trust and safety in financial transactions, ensuring a safe, secure, and efficient environment for all users.

- Economic and Social Impact: The service enables governments and NGOs to disburse funds efficiently to citizens and beneficiaries, streamlining processes and improving transparency in financial aid distribution. This function is vital for managing large-scale disbursements in response to emergencies or aid programs.

- Global Reach: MasterCard Send facilitates global financial interactions by connecting to a vast network of banks, mobile operators, and money transfer organizations worldwide, making it a practical choice for international transactions. The service operates around the clock, offering 24/7 support to ensure a seamless and hassle-free experience for all stakeholders.

- Single Correspondence Channel: MasterCard Send acts as a single correspondence channel for all remittances, simplifying the communication process and enhancing the overall user experience.

Understanding the Costs Related to MasterCard Send

The transaction costs for using payment services like MasterCard Send vary based on the fees set by the involved parties. MasterCard Send manages payment processes but does not handle the actual money transfers. Instead, companies such as Western Union, MoneyGram, and Wise are responsible for transferring the funds. Consequently, MasterCard Send does not impose a transfer fee for its services.

Card-issuing banks may charge fees for these transactions. Businesses, government bodies, or other organizations involved may also charge fees for conducting money transfers. These transactions involve multiple partners, each contributing differently.

Additionally, recipients using MasterCard Send to receive payments in a foreign currency will incur a fee based on the exchange rate. Companies also charge a convenience fee for instant cross-border payments for international transactions. Customers should thoroughly check and understand all associated fees before selecting a money transfer provider.

How Do You Start Sending and Receiving Money with MasterCard Send?

Your business can utilize MasterCard Send to make payments to anyone almost immediately.

To begin using MasterCard Send, you must register for the service. This usually involves visiting the MasterCard Send website and setting up an account. After your account is active, you can connect your bank account or card to the service.

To send and receive money, first sign up by completing an information request form on the MasterCard Send website. The service will require you to provide a photo of your passport, ID card, or driver’s license to verify your identity. Once registered, you can deposit funds into your account using a bank transfer or debit card. Bank transfers and debit card payments are preferred due to their ease of use. Next, go to the transfer page, enter the recipient’s details, specify the amount you wish to send and click “send”.

After completing the transaction, wait for a confirmation that the recipient has received the funds.

If you need to receive money, access your dashboard and select the currency to be received. Then, choose to view payment details and share this information with the person or business sending you funds.

After the sender confirms the transaction, simply wait for the funds to arrive. Transfer times vary, but if both parties use MasterCard Send or the same bank, the funds should reach you within 30 minutes.

Conclusion

MasterCard Send is a valuable tool in the evolving payments and transactions sector, offering secure and swift payment management for various needs. Its ability to facilitate near-instant transfers to almost any debit card in the U.S. provides broad accessibility without requiring detailed bank information. By supporting diverse payment channels and types, including domestic, international, and person-to-person transactions, it meets the needs of businesses, governments, and individuals alike.

Additionally, the platform’s robust security measures and global reach enhance trust and efficiency in financial interactions. MasterCard Send’s integration with existing banking systems and transparent cost structure make it an effective solution for modern payment challenges.

Frequently Asked Questions

What is MasterCard Send?

MasterCard Send is a global platform that allows quick and secure fund transfers. It supports three types of payments: disbursements from businesses or governments to consumers, domestic person-to-person (P2P) transfers within the same country, and cross-border P2P transfers between different countries.

How does MasterCard Send work?

A sender starts a transaction through a Transaction Originator who collects debit card details and initiates the transfer via MasterCard. MasterCard processes the transaction and sends it to the recipient’s bank, which then credits the recipient’s account. Transfers usually happen within seconds, but timing can vary based on the recipient’s bank.

Who can use MasterCard Send and what types of payments can it handle?

MasterCard Send can be used by individuals, businesses, and governments. It supports various payments like insurance payouts, government aid, merchant settlements, gig worker wages, and P2P payments, allowing transfers to nearly any U.S. debit card and many international cards.

What are the benefits of using MasterCard Send?

MasterCard Send offers near-real-time fund transfers, ensuring quick and secure transactions. It can send money to almost all U.S. debit cards and many international ones, supporting both domestic and international transfers for various financial needs.